In just 20 years, self-pay care revenue loss for providers has nearly doubled. In 2000, providers lost $21.6 billion to Uncompensated care costs, and in 2020 that cost grew to $42.67 billion. (Source: AHA Annual Survey data 2000-2020). What is your organization doing to curb this trend?

Even with the introduction of the Affordable Care Act (ACA) in 2010, there is still a significant percentage of patients that don’t have insurance coverage and/or are unaware they have the opportunity to obtain coverage through state programs.

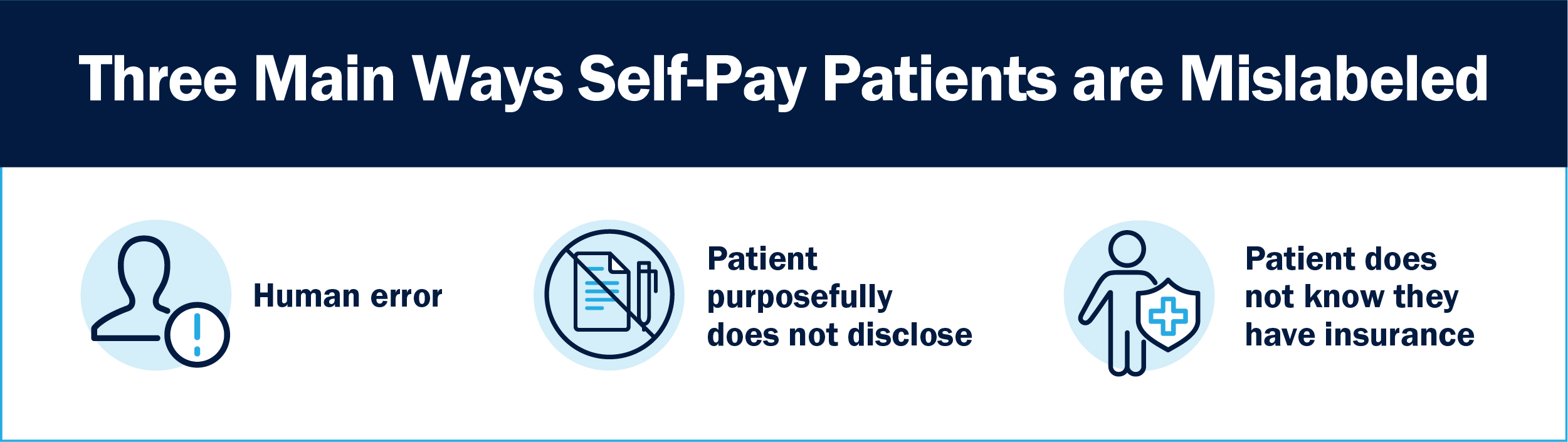

There are three main reasons why a patient mistakenly present as self-pay:

- Registration entry errors during in-take. Incorrect demographics were entered preventing eligibility from being identified during standard flow down.

- The patient did not disclose and/or provide insurance card.

- The patient is unaware they have coverage. More than 60% of Americans are confused about health insurance, it’s not uncommon for a patient to be unaware their employer auto enrolled them in a group health plan and/or they have state assistance programs they are covered by.

Providing care to all that need it, regardless of having insurance or not, is a provider’s duty. There will always be self-pay/uncompensated care costs to a provider, reducing that expense as much as possible will allow communities to continue to receive quality healthcare. Self-Pay/Uncompensated care costs continue to compound as those mislabeled accounts progress through a provider’s Revenue Cycle flow down.

The solution: deploying Bluemark’s Insurance Discovery solution, providing peace of mind all billable insurance is identified prior to writing off permanently. Bluemark offers a no-cost trial to all end users validating ROI prior to commitment.

What is insurance discovery?

Insurance discovery at its core involves continuous innovation and skilled experts navigating the complexities of our ever-changing industry producing optimal outcomes. Cleansing Self-Pay/Uncompensated care population of “Active” insured accounts at any of the 3 stages of the Revenue Cycle will provide a safeguard preventing revenue leakage while supporting a more efficient Revenue Cycle system.

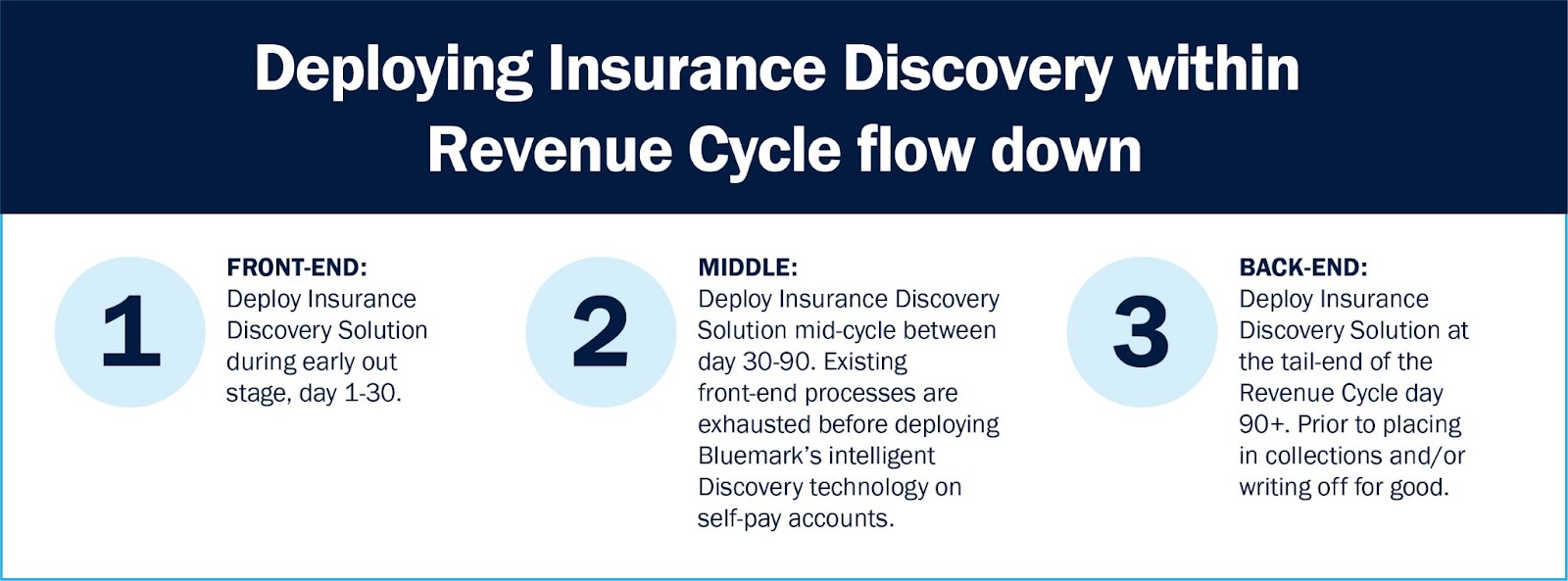

Deploying Bluemark’s Insurance Discovery solution will make an immediate impact to a provider’s Revenue Cycle performance, combating the trend over the last 20-years of Self-Pay/Uncompensated care rising cost. There are 3 stages in the Revenue lifecycle where insurance discovery can be seamlessly positioned:

1. Front End: Early out stage

When patients are first classified as self-pay, hospitals and health systems can implement Bluemark’s Insurance Discovery technology to maximize early revenue capture during the initial 30 days.

- Registration entry errors: Bluemark’s technology is able to correct errors in demographics during in-take resolving discrepancies early on in the process reducing resource and carry spend.

- Verification and Secondary screening: Bluemark’s technology to verify insurance information is active and returns patient information for billing. Can drill down to secondary and tertiary coverage identification assisting in Coordination of Benefits.

- Early on eligibility: Using most robust insurance discovery technology early expediting reimbursement from payers. Cash acceleration application.

- Reduces revenue leakage: Prevents “Active” insurance on date of service accounts from moving their way downstream.

Note that file exchanges required to perform these checks are free of charge, but the process can be time consuming for busy health systems. There are also third party solutions that will perform these upstream checks on a per-transaction basis.

2. Middle: Specialty stage

During the middle stage of the revenue cycle, day 30-90 as an example, is where specialized point solutions can drive revenue recovery such as Bluemark’s Insurance Discovery solution. On the front end, most solutions are broad and all encompassing off the shelf tools that are not customized for each provider. Those are cheaper volume based applications that do not offer “white glove” experience. That opens the door for errors and omissions to occur where a specialized point solution during the middle stage of the revenue cycle can fill those cracks.

- Recycling of self-pay accounts: Bluemark never gives up! Medicaid policy supports retro or latent eligibility, Bluemark runs previously received self-pay accounts where no insurance was identified each review period until they fall untimely.

- Validation: placing Bluemark’s Insurance Discovery solution in the middle stage will provide reassurance front end solutions are performing at a high level or Bluemark will prevent those billable opportunities from progressing further downstream.

- Contingency fee pricing model: Bluemark is only paid upon success, with no upfront costs or junk fees.

- Timeliness: deploying Bluemark’s Insurance Discovery solution between 30-60 days will maximize commercial recovery success. Once day 90 hits, commercial success is limited based on provider contract terms.

3. Backend: Safeguard back stop

As a safeguard, providers should have a solution in place as a last effort before closing out/placing in collections/writing off a self-pay account permanently that cleanses those accounts of all “active” insurance that can be billed around at day 90+. Many things can happen during the lifespan of a self-pay claim that can change its designation, turning it into revenue instead of a cost.

- Medicaid retro or latent eligibility: this is one of the main reasons to perform a last effort before closing an account out for good and/or moving it to collections. Bluemark’s intelligent technology is able to maximize a provider’s recoveries prior to losing opportunities to timely filing limits for good.

- Safeguard: last back stop for peace of mind, all billable coverage was captured during front and middle stages of revenue cycle.

- Commercial success: Commercial success is limited to a provider’s contract with payer(s) on timely filing limits at 90+ days.

- Collection agency offset: If working with a collection agency, inserting Bluemark’s Insurance Discovery solution prior to offloading bad debt will increase return.

This process is nearly impossible to conduct manually as it relies on algorithms that automatically search for variations on a patient’s name, address and other information. With a comprehensive insurance discovery solution in place, your team can find as much as 30% of self-pay accounts actually have billable insurance, leading to millions in potential revenue recovery.

How can I improve my Insurance Discovery process?

Does an automated solution that finds insurance coverage where all other processes have failed positively impacting your revenue cycle sound like a far off dream? In reality, for many organizations, self-pay management of this nature is well within reach. In fact, many pieces of this framework can be implemented as soon as today!

Bluemark and Office Ally are redefining self-pay revenue recovery. We are pleased to offer insurance coverage discovery, featuring:

- Increased revenue by identifying billable insurance within self-pay accounts

- Contingency fee-based with no activation or set up costs

- Provider only pays upon success

- No additional fees for custom reports and/or configuration

- “White Glove” experience tailoring solution for each end user

- 10-30% success rate on every file

Insurance Discovery means you no longer need to waste time and resources sifting through a high number of ineligible claims you can’t bill as they are false positives. Our team has over 100 years’ experience in this field, consistently finding significant revenue opportunities where other solutions have failed.