Guidelines for Better Managing Self-Pay Patient Populations in 2021:

In the coming months and years, wise hospitals will recognize and prepare for an inevitable increase in self-pay patients. The COVID-19 pandemic has resulted in millions of Americans losing their jobs and, consequently, health insurance. But regardless of insurance status or ability to pay, sick and injured patients will end up in your emergency department.

Once the vaccine is available and hospitals resume regular patient volumes, the number of self-pay patients will only increase even further. What can a financially savvy health system do to prepare for this increase. These five guidelines will help you better manage the influx and convert self-pay patient accounts to revenue through proactive financial assistance in 2021.

1. Revamp coverage discovery

The first step in increasing your efficiency with self-pay patients is to identify just who these self-pay patients are. You may think this is a fairly basic concept, but many accounts end up in the patient registration metaphorical abyss as staff work to determine if they have insurance at all, what insurance they have, etc. Sometimes patients are tagged as self-pay but really do have insurance, sometimes patients have insurance but are labeled as self-pay.

Revamp your registration process to better identify coverage sooner in the process rather than later. Establish a process to verify that self-pay patient accounts truly do not have any type of insurance before they reach Patient Financial Services. It may help to create a task force dedicated to identifying current processes, seeking out efficiencies and implementing them within your organization.

2. Establish a relationship with your self-pay population

In a hospital setting, there is generally a relationship, whether positive or negative, between a patient and provider due to care. A patient interacts regularly with the doctors and nurses assigned to their case and the longer the hospital visit, the better chance of a positive rapport.

However, there does not usually exist a relationship between that same patient and the financial services department. Even though the department’s job is to help the patient, patients usually blur the line between financial services and collections or billing. Patient financial services exist as a resource to help patients, but the department is constantly combating distrust and lack of direct contact with the patient to establish any sort of relationship.

Work to identify and implement measures to proactively establish a relationship with your patient population as a whole. If this task seems Herculean, start with just the self-pay patients. How can you improve outreach and engagement for a more positive relationship and a better chance of enrolling the patient in a financial assistance program?

3. Always check patient history

There’s never a need to reinvent the wheel, so to speak. If a patient has previously been approved for financial assistance within your organization, you may not need to re-enroll or re-screen for eligibility.

First, establish a policy for previously approved patients. Many hospitals state that financial assistance approvals are good for a certain amount of time, usually 90 days, six months or one year. This will save you valuable time and effort. You may still have to update a few pieces of key information to validate that they’re in the same circumstances as when they were approved, but this is still much easier than completely re-screening.

On a related note, patients are often going to come back to your hospital for further care, especially if you work in a community hospital. If someone comes to you four times in one year but they weren’t approved for financial assistance until the last time, you miss out on that revenue. If you catch these patients on their first visit, they’ll have coverage for the subsequent instances of care.

Even if that patient specifically does not return, their family may have a need for care. For financial assistance programs like Medicaid, you will typically enroll a full family for assistance. Covering the original patient on their first visit means you have covered their full family for the foreseeable future.

To make this self-pay patient guideline as simple as possible to execute, ensure you have a system for tracking financial assistance approval for individuals and families that all relevant personnel can access. Consider creating an audit process wherein staff checks previous approvals on all accounts with a high balance because of co-pay or high deductible plans. Get any previously approved accounts settled quickly.

4. Tie accounts together throughout your system

When a patient is admitted to the ER, they may experience any number of treatments. They may be referred, get tested, get X-rayed, get lab work done, etc. When examined individually, each one of these instances alone may not appear to be worth a lot of effort in terms of resolving the account or finding reimbursement.

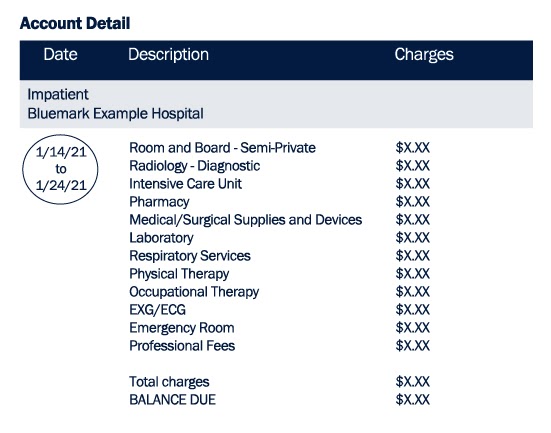

However, when you start pulling all care actions together, you may start to see that it is worth the time and effort to proactively assist this patient in settling their account. Consider this example:

This patient stayed in the hospital for 10 days after being admitted to the emergency room. They received several different services over the course of the stay from departments in house, including radiology, physical and occupational therapy, lab work and more. If this self-pay patient relapses or returns for another visit within a few months, they may even double this bill by experiencing these services again. Without a way to pull all services and visits together into one account, you lose the full picture of the patient’s circumstances and hinder your team’s ability to proactively help.

Having a way to pull together the patient’s data or information and gain a broader view of their big picture financial situation can completely change the way you approach the account. This is especially true if your health system is expansive and covers several different care departments under one roof.

5. Leverage available self-pay management technology

Perhaps the most important guideline of all in better managing self-pay patients is investing in the proper technology that makes it easy for all team members to implement points 1-4. Any system that deserves your time and money should be one that can aggregate patient accounts, check for patient history and cover and make outreach and engagement easy for both parties.

Automation that utilizes rules and established workflows to move accounts through a system should be a huge part of your processes going into 2021. This concept is not in line with artificial intelligence per se, but the right technology has a level of intelligence built into it that dynamically changes the workflow based on inputs. For example, if a patient indicates that they are not a U.S. citizen, a workflow can and should automatically adjust which programs the patient is eligible for.

In addition, investing in technology can give you the ability to collect, analyze and report on self-pay patient data all in one place. Then you can better identify problems, opportunities for improvement, results, effectiveness and more.

If you’re in need of software to automate your interactions with self-pay patients, Bluemark’s MAPS program was developed specifically to address the concerns addressed in this article. MAPS makes it simple to identify, screen and interact with self-pay patients in need of financial assistance.

The Bluemark team is filled with experts who have years of experience within self-pay management. We would be happy to have a conversation about ideas and best practices to improve your process. Click here to contact Bluemark.