How COVID-19 Has Impacted the Healthcare Revenue Cycle:

Without a doubt, the COVID-19 pandemic has upended the U.S. healthcare system. The financial losses have been felt for months and will continue to affect revenue cycle management into the near, and potentially far, future.

While many healthcare personnel are eager to get back to “normal,” it is our responsibility in the patient financial services (PFS) sector to create and move forward with a new perspective. This approach should embrace the changes brought about by COVID-19 and consider cutting activities and expenditures that have been on hold for months as a result of the pandemic.

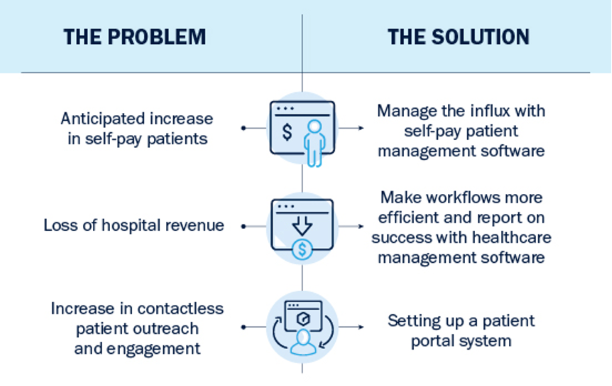

This time of change is an opportunity for providers to create new strategies, processes and goals to shift to a more efficient way of doing business. It’s time to assess what has happened so far and how we can adapt to these changes into 2021 and beyond. These three changes are some of the biggest we’ve seen in the industry that require modern, technology-driven solutions for future success.

1. Anticipated increase in self-pay patient volume

Outside of the devastating health crisis, one of the biggest consequences of COVID-19 has been its economic impact. The entire globe is grappling with the economic fallout and how to maintain prosperity, despite rising unemployment and strict lockdowns that have even the most long-standing businesses closing their doors.

As we’ve seen in the United States, these job losses mean many patients are losing their health insurance as well. Toward the end of August 2020, a study released by the Economic Policy Institute estimated 12 million Americans had lost employer-sponsored healthcare as a result of COVID-19.

But if these patients get sick or injured, there’s a high probability they will find themselves in your Emergency Departments regardless of insurance status. The number of self-pay patients can only be expected to increase after the introduction of a vaccination when hospitals resume standard patient volumes again.

An influx of self-pay patients means you must be ready to collect on revenue by enrolling eligible patients in financial assistance programs as quickly and efficiently as possible. Interaction with patients must be down to a science while maintaining sensitivity and bedside manner.

The technological solution

Investing in self-pay patient management technology can drastically increase workplace efficiency. Software platforms designed to conduct rapid assessments and interact with patients online may be critical in managing the expected influx of self-pay patients in 2021.

By streamlining the process for financial enrollment, patients can get a better idea of what information is needed from them and when. Online interaction also introduces an element of convenience that can make patients likely to respond and submit materials online. Overall, streamlining the process helps staff manage increased caseloads and convert as many outstanding patients as possible to Medicaid or similar assistance programs.

2. Loss of Hospital Revenue

Back in May 2020, the American Hospital Association estimated U.S. hospitals would lose an average of $50.7 billion per month through December 2020. Many hospitals were spared this bleak fate with federal aid, but health systems have still seen significant losses. One study estimates 28% of hospitals are currently operating in a negative profit margin.

As a result, PFS departments nationwide are facing resource challenges this year, most commonly furloughs, layoffs and budget cuts. Combine this with an influx of self-pay patients and suddenly a smaller or reduced staff is required to handle a larger volume of self-pay accounts.

The technological solution

Again, investing in specialized software designed to assist in managing self-pay patient accounts can make all the difference in increasing revenue. For one, a smaller staff can more easily take on a larger volume of accounts when workflows are automated. When staff know exactly where each account stands and which ones are waiting on action, fewer patients slip through the cracks.

Additionally, these types of software can make hiring and staffing decisions easier with specialized, to-the-number reporting features. Getting the hard data on how staff is performing vs. how much revenue is being generated shows leadership whether the department has the financial capacity and time available to bring on a new staff member and lighten the load for others.

3. Contactless outreach and engagement

In PFS, part of the job is interacting with patients to help them with assistance program assessments. Due to COVID-19, many hospitals have switched to contactless outreach and engagement, completely changing the nature of the job some financial counselors have done the same way for years.

Now staff must effectively reach out, engage and work with patients in an online, remote environment to get them approved for financial assistance. This can lead to extended timelines, too much back-and-forth between the patient and the financial counselor and overall decreased patient satisfaction.

Aside from COVID-19, the demographic shift in patients has been contributing to a demand for virtual engagement for years now—Millennial and Generation Z patients often prefer to interact online rather than in person or over the phone. The more often information and service is available to them on demand, the better.

The technological solution

Enter the patient portal, a technology tool that helps screen and assess patients without requiring in-person contact. Information needed to complete the screening process can be uploaded by both the financial counselor and the patient, including electronic signatures, pay stubs, birth certificates and more. With a portal, patients are able to supply important documents by scanning and uploading papers to their computer or even taking a picture with their phone.

Portals can also give patients several communication options, including texting, phone calls and email, providing the freedom to choose their preferred contact method. Making the process easier on both ends by sharing information through a portal can increase patient satisfaction and reduce the burden on staff to complete enrollment.

Investing in technology to combat the impact of COVID-19

Working smarter, not harder, is the new world of revenue cycle management. Technology has been used to increase efficiencies in PFS for the past two decades, but the challenges brought on by the pandemic have given many hospitals an ultimatum. Health systems must adapt to and invest in technology to succeed in a post COVID-19 environment.

Specifically, self-service tools will be needed to support contactless engagement models to maintain and increase patient satisfaction. Evolved enrollment processing capability, featuring more automation and less manual actions, will enable stretched resources to handle more accounts. Highly sophisticated management tools and reporting will need to be in place to ensure PFS teams operate at the highest level of efficiency and no reimbursement opportunities are missed.

Bluemark offers these technological solutions in the form of self-service tools that can assist in meeting the needs of today’s new normal. Our MAPS platform is specifically designed to enhance providers’ existing self-pay management processes—whether outsourced or in-sourced—to efficiently screen and enroll patients for all types of programs, including Medicaid, Financial Assistance, health insurance exchanges and more.

If you’re looking to technology to lay the foundation for success in 2021, Bluemark is the answer. Schedule your free, no-commitment demonstration and our team of experts will show these solutions in action. Click here for more information.