In September 2021, the United States added 194,000 jobs to the labor force. In that same month, hospitals collectively lost 8,000 jobs, according to the U.S. Bureau of Labor Statistics.

These numbers are part of a larger trend clearly indicating that healthcare organizations are facing a shrinking workforce in what is still the midst of a global pandemic. American hospitals are in desperate need of a way to do more with less.

The solution? Better workplace technology.

The State of the Hospital in 2021

Over the past year and half, the ebbs and flows of the COVID-19 pandemic have filled many hospitals to capacity. Back in 2020, clinical teams scrambled to create COVID wards overnight while their revenue cycle team counterparts adjusted billing processes and made sense of rapidly changing insurance policies. It took months for the resulting chaos to die down, and many hospitals are still working through the aftermath.

Additionally, since the start of the pandemic, employment in the healthcare sector has decreased by about 524,000 workers. Some workers were laid off, but many others quit. From the start of the pandemic to now, an estimated one in five healthcare employees left their jobs voluntarily.

All this means that hospitals are working to meet the demands of a global pandemic with fewer resources—including cash flow. Labor shortage and low capacity have led to the suspension of many non-essential surgeries, which takes a toll on revenue. And to attract new talent, hospitals are increasing wages and hiring high-cost contractors to temporarily fill vacant positions.

Technology solutions for labor-related problems

With a shortage of labor, money, space and, arguably, time, hospitals looking to be more efficient need to invest in technology solutions. Gaps that aren’t filled with some sort of solution (technological or otherwise) will only continue to grow.

But hospital finance personnel often balk at the idea of a new technology solution because of the perceived upfront costs, especially when the labor shortage has already significantly reduced their bottom line. That’s why many vendors are offering pricing models that significantly reduce up front fees or eliminate them entirely in favor of ongoing licensing fee models.

Additionally, people tend to look at technology as a capital expense, but it’s becoming increasingly apparent it may better be viewed as an operational expense, like labor. It’s a tool designed to fill the gaps in your processes that cannot be filled without hiring personnel—which are in short supply at the moment.

With the right technology, hospitals can experience as much as a 25% increase in efficiency in their processes rather than continued regression.

What can technology do to automate revenue cycle processes?

At its core, technology provides the basis for automation in the revenue cycle, which reduces the need for manual labor.

There are two main drivers behind automation in the revenue cycle process: system integration (sharing data across multiple systems) and business intelligence (clearly defined process rules and workflows).

1. System Integration

System Integration or sharing data is a key way to minimize human involvement in revenue cycle processes. Creating interfaces where your technology shares data drastically reduces the amount of time and labor spent on things like manual data entry, a process which can take hours and in many cases is truly unnecessary.

2. Business Intelligence

Incorporating business intelligence and workflow rules allows for accounts to move through a process without human interaction. With data automatically uploaded and rules already set in place, accounts can automatically progress from one step to the next with little manual intervention in between.

With these two factors in place, software can use automation to fill the positions that have gone unanswered on your job board for the past few months.

What can technology do within patient financial services?

There are several specific instances where an effective software solution can step in for manual labor in your patient financial services department (and make things more efficient in the process).

• Automated data entry

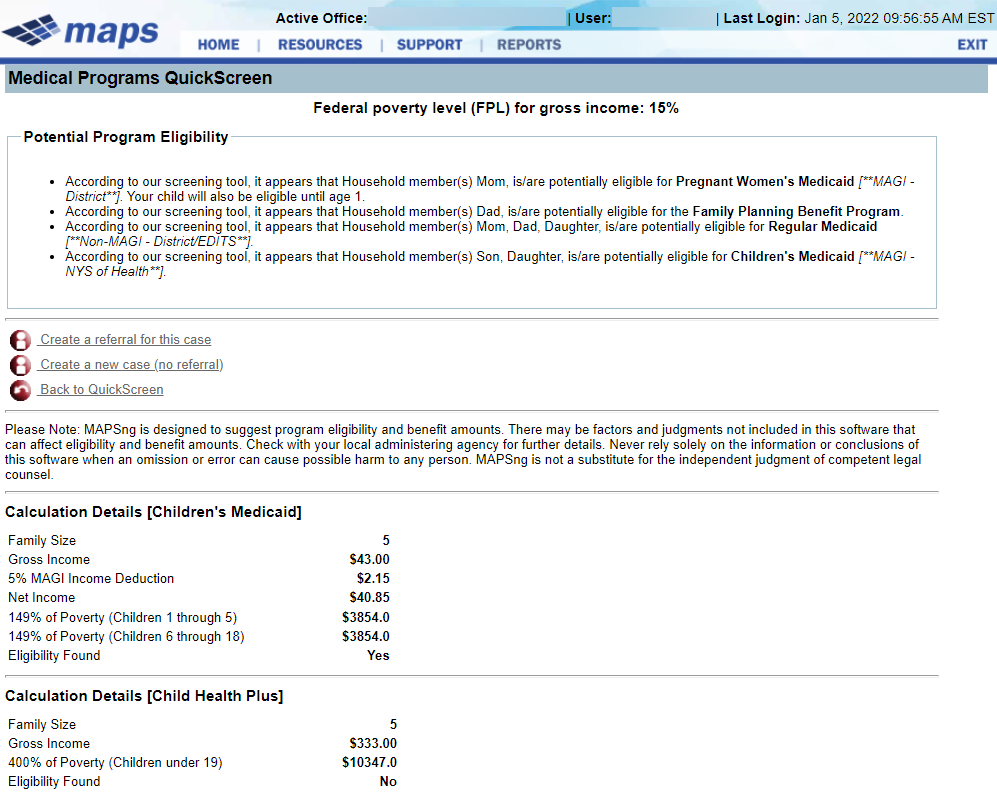

Consider the patient account screening process. Instead of sending someone to the patient’s hospital room for demographic information, you can use technology to integrate a screening tool that leverages known patient information (name, phone number, address, initial charges) and imports a standard set of data into the screening tool.

In our experience, the sheer volume of time and labor saved by eliminating manual data entry is often enough to push hospital finance departments nearly all the way to that goal of a 25% increase in efficiency!

• Patient portal facilitation

With technology, hospitals can create an automated self-service patient portal which allows their patient population to do some of the initial screening without the help of an employee.

Answering just a few basic initial questions can be enough to move the patient’s account further along in the enrollment process. The system should be able to flag accounts that may need human interaction.

An effective system also creates automated messaging for patient outreach. You can use technology to set up a rule that indicates if an account has not been screened in two weeks, the system will automatically send an email directing patients to the self-service portal to start the process. This is in contrast to an employee examining every account or manually keeping track of the ones that still require outreach.

With technology facilitating automation, accounts no longer need to be picked over with a fine tooth comb or manually approved for service. Employees are free to focus their limited time elsewhere.

• Automated decision making

You can also automate the patient account’s financial assistance approval. Rather than having an employee manually collect the patient’s data and use their own knowledge to determine the best course of action for financial assistance, simply automate the process.

For example, you can set up a rule that automatically approves an account for financial assistance given a certain set of criteria. Say, if a patient’s account is less than $5,000, the initial screen (conducted via the patient portal) indicates they are eligible for assistance and they filled out an application, a technology system can automatically approve the account rather than having someone manually go in and review the account and click the approve button.

The majority of your time, energy and money savings will come from using technology to automate manual processes. Setting up systems with rules based upon your current process will keep accounts moving with less human interaction (or none at all).

What can technology do within the audit response process?

As with patient financial services, technology can also play a role in combating a labor shortage within the audit department and take the response process to the next level by eliminating much of the need for labor.

• Digital notification and release of information

In addition to patient portals, technology can offer online portals designed to securely and safely exchange information between payors and providers.

The ability to digitally submit documentation and medical records to approved audit contractors means less time and energy printing out, organizing and manually sending over an audit response. Receiving audit requests online also means audit teams no longer have to wait for ADRs in the mail and have more time to finalize their response.

The majority of portals are qualified to perform information exchanges for commercial or Medicaid audits. But remember, when it comes to Medicare audits, only a handful of select organizations are certified by CMS as health information handlers. Only technology from these companies (Bluemark among them) can provide a secure gateway for information exchange in these use cases.

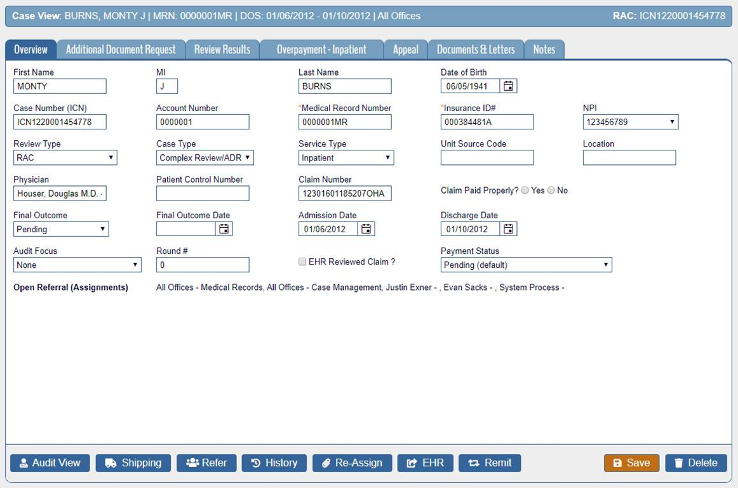

• Custom configuration and audit-based system integration

No two audits are created equal. The right technology allows you to set up processes that reflect specific contracts with commercial payors, state Medicaid audit rules, Medicare, etc. and streamline the response from start to finish.

Not only can you receive audit requests electronically, you can automatically input data from that request into an audit tracking and management system that already has claims and remittances data from your HIS. From there, you can track deadlines, team productivity and audit results.

The time savings that can be brought about by audit management technology is staggering. This automated process is, of course, all in contrast to receiving a documentation request by letter, going into your spreadsheet, manually entering data and following up with information requests individually.

With a technology based solution, employees will be able to respond to more audits with better accuracy and hours of time savings. Talk about doing more with less!

The era of automation is upon us

While experts agree the labor shortage won’t last forever, it’s also not expected to end anytime soon. Investing in technology now will, in the short term, ride out this shortage and, in the long term, optimize and improve key processes to increase revenue and ensure the hospital is prepared for any future disruptions.

At Bluemark, we strive to help hospitals do more with less, aiming for a 25% increase in efficiency for all client users. Our team is full of experts skilled in using technology for better resource management.

We are eager to have a conversation to better understand your organization’s needs and how specifically we can apply technology to alleviate the burden of restricted resources.