No one ever wants to end up in the emergency room (ER), but accidents and health emergencies happen, and you may wind up a patient in need of immediate care without health insurance. If you do go to the emergency room without coverage, don’t worry. The hospital is required to treat you regardless of insurance status.

Under the Emergency Medical Treatment and Labor Act (EMTALA), anyone who goes to the ER must be stabilized and treated, even if they are uninsured and it’s not clear how they will pay for treatment. The law was enacted to ensure healthcare providers do not transfer uninsured patients or deny them critical treatments.

But any amount of care is not free. Even non-emergencies or short stays will generate a bill. If you or your insurance cannot pay that bill, who will?

Why would someone not have health insurance?

There are many reasons why people don’t have health insurance. To name a few:

- When you leave your job for any reason, whether it’s voluntary or involuntary, you are no longer eligible for employer-sponsored health insurance until you find a new position.

- Contractors or freelancers who run their own small businesses rather than working for someone else may not have health insurance.

- People who work part-time are generally not eligible for employer benefits like health insurance.

- Any number of unexpected life events.

If you have been fortunate enough to be able to afford medical care throughout your life, it can be difficult to truly understand why someone may be uninsured. But in the U.S., one out of every five adult patients and one in three children receive health insurance through government-sponsored programs. These people may very well be your friends, family, neighbors or peers.

Who pays for uninsured patient treatment?

Financial assistance programs are available to cover uninsured patient treatment, assuming the patient meets certain qualifications. Many Americans are enrolled in government-sponsored insurance programs like Medicare or Medicaid. There are also plenty of other public and privately held financial assistance options.

If a patient does not qualify or attempt to enroll in one of these programs, the cost of care will be written off as an expense for the hospital. Both the hospital and the uninsured patient don’t want to shoulder the cost of care, so it’s in both parties’ best interest to enroll in one of these programs. The process starts with the hospital’s financial counseling department.

Improving the patient and financial counselor relationship

Patients often dread working with financial counselors, but this distrust is misguided. While doctors and nurses assess your physical health and provide medical solutions, financial counselors assess your financial condition and determine the best way to provide monetary assistance.

Financial counselors are typically not equivalent to the collections department, nor are they looking to take money from you. They want to help cover your care so you aren’t saddled with medical debt after leaving the hospital.

That being said, any wariness of financial counselors is understood. A patient is almost always under a lot of stress coming into the ER, especially without insurance, and the last thing they want to think about is payment. It’s key that financial counselors remain empathetic, calm and delicate when working with uninsured patients.

To improve relationships with patients, financial counselors should examine their current processes and policies and look for improvements. Below are three common key areas where financial assistance departments can often stand to improve.

1. Earlier Intervention

In financial assistance, early intervention is key. Once patients leave the ER, their account moves to the billing department and it becomes exponentially more difficult for the hospital to track them down and help them find coverage. For best results, financial assistance teams should intervene as quickly as possible after medical diagnosis and stabilization.

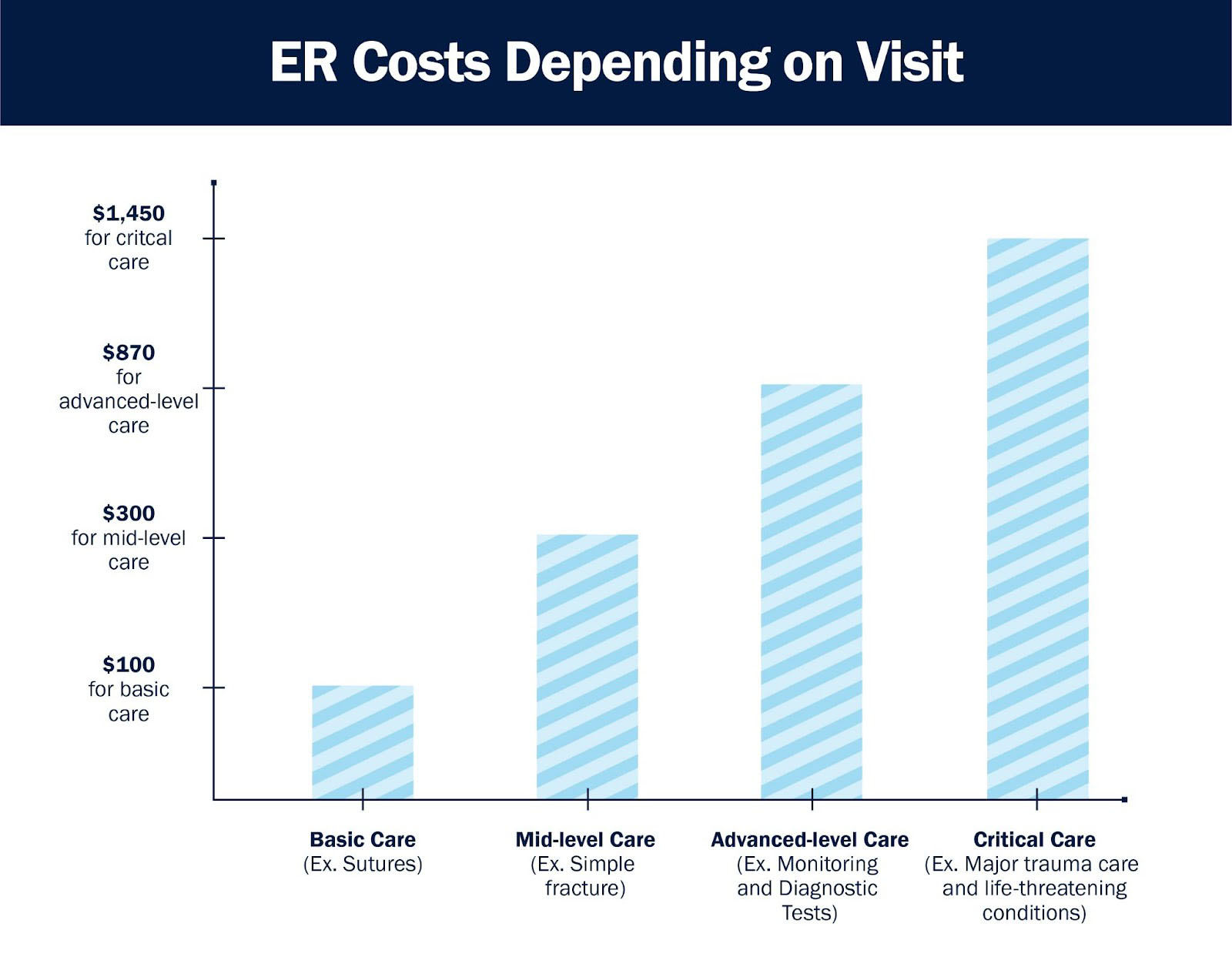

However, intervening early does come with its own set of sensitivities. A patient may not always be interested in talking money right after a life-saving treatment or sobering diagnosis. But the average ER bills ranges from $150-$3,000, and no one wants to leave treatment with that responsibility. Financial assistance teams should be trained in empathy and should be familiar with the patient’s case before jumping right into finances.

It’s critical for financial personnel to emphasize they are not delivering or collecting on a bill, but only interested in working with the patient to get them into an enrollment pathway into an appropriate financial assistance program or payment plan. Getting to know a patient and their specific situation will only help determine the appropriate course of action to ensure no one ends up saddled with a medical bill.

However, with tens of thousands of uninsured patients coming into the hospital each year, getting staff into every patient’s room long enough to screen each patient for financial assistance eligibility requires both time and resources. And these days, many hospitals don’t seem to have enough of either.

2. Leverage Technology

Unlike the traditional working world, the ER is not at its busiest from 9 AM to 5 PM. Instead, emergency departments see the highest volume of patients on the off hours between 5 PM and 9 AM and on weekends. Hiring people willing to work second and third shifts is difficult, meaning financial assistance departments are often working with limited staff screening high volumes of patients.

The best way to workaround the staffing challenge and avoid making patients feel like they’re an item on a checklist is to invest in a technology solution for self-pay patient management. Instead of interviewing patients and manually determining the best course of action for financial assistance, counselors can use a screening tool that only needs the patient’s answer to a few simple questions.

Leveraging a screening tool allows for rapid assessment and faster follow up. A good tool can also let patients give the hospital authorization to represent them in the financial aid process, which makes it much easier to enroll the patient in the right program even after they’ve left the hospital.

3. Improving Self-Service Follow Up for Discharged Patients

Of course, not every patient admitted to the ER will remain there for an extended period of time, or even overnight. Almost 90% of patients will be back home or referred to another healthcare provider without the need to be admitted.

If counselors could not complete the financial assistance enrollment process prior to discharge, it’s in a hospital’s best interest to follow up with the patient to continue the process. And not just because it’s important to cover every visit to avoid write offs.

In some cases, emergency rooms average 4.5 visits per person per year. The same people often come back to the hospital with chronic illnesses or persistent issues. If that patient comes in four times and leaves all four without enrollment in insurance, the patient will end up with a large debt burden and the hospital will end up with four potentially unpaid bills.

However, if that patient is enrolled in Medicaid on their first visit, their subsequent visits are often covered, depending on the time between trips to the ER. Even if that patient leaves the ER, it only makes sense to reach out with financial assistance counseling information, as the likelihood they will return remains high.

At the very least, hospitals should maintain and optimize a system for communicating with discharged patients using a mix of digital and print correspondence. But technology is the ideal solution for improving patient follow up. Access to a self-service portal can allow patients to fill out an application for enrollment, or authorize a financial counselor to fill out the form for them even if they’ve long since left the hospital.

Getting uninsured patient coverage requires the right technology

Ideally, hospitals should both invest in a technology solution and use it to integrate the financial assistance screening into the emergency department’s registration process. That way, staff are not required to interrupt a patient in recovery and patients who leave without talking to financial counseling are easier to reach and find coverage for via a self-service portal.

Leveraging technology supports counselor-patient interaction as it can mean the difference between making a patient feel cornered discussing their bill right after treatment and allowing the patient to decompress before approaching them at the right time. Self-service portals also allow for easier access to discharged patients and can make younger generations of patients raised on technology feel more in control of the process.

Bluemark’s MAPS software solution helps hospitals convert their self-pay patient population into revenue generating assistance programs. It optimizes an increasingly challenging enrollment process while catering to shifting patient demographics and giving hospitals the confidence to provide top-tier financial assistance amidst a growing labor shortage.