Which Self Pay Management Model is Right For You?

The goal of a self-pay management strategy is to quickly and accurately identify assistance program eligibility and to facilitate the enrollment process. As with any process in your workplace, there is always room for improvement and optimization on self-pay patient management, whether you currently keep the process in-house or outsource it.

If you’re starting to feel like your current self-pay management strategy is no longer the best for your organization and its bottom line, you may be considering changing it up. The best way to make an informed decision is to compare your current metrics to the results you have the potential to see when switching strategies.

Traditional self-pay management models

Health System revenue cycle leaders are continually faced with a choice in deciding how to most effectively and efficiently manage their self-pay patient populations. Typically, there are three approaches to managing self-pay populations:

- Utilize internal staff: Keeping all operations in-house so that only staff working in your hospital system manage self-pay patients from start to finish. In this case, staff has full control over how accounts are managed and what strategies and tools are put into place.

- Engage an external vendor: Also called outsourcing, this option forgoes internal staff in favor of having all self-pay patient management conducted by a third party specializing in revenue reimbursement. External vendors typically charge a contingency fee on a pre-agreed upon basis for their services.

- Hybrid model:This option leverages some combination of the first two options and is the most common, using both in-house staff and external vendors for self-pay management.

All options have pros and cons. The biggest downside to using only internal staff is that they can get easily overworked managing self-pay accounts. It can be difficult for staff to find the flexibility and capacity to absorb influxes in self-pay patient volume. But the upside is their familiarity with your operation and dedication to their team and company. The biggest downside to using external vendors is the cost, while the biggest upside is the ability to outsource a service to a specialized team.

It is crucial to note that there is an emerging fourth model not mentioned above that can work as a viable option: Utilizing internal staff equipped with software as an enablement tool. A technology platform is the only guaranteed way to maximize the internal model. It maximizes efficiency and effectiveness and takes in-sourcing to an entirely new level.

All in all, one of the main goals of optimizing your self-pay management is to make an informed decision as to which model is right for you. It is up to the health system revenue cycle leaders to choose which of these four options makes the most sense for their organization.

Choosing the best self-pay management model

Health systems generally choose a model based on cost effectiveness. Other factors can play a role, like the size of the hospital, number of self-pay patients and internal requirements, but it’s rare that cost is not the main factor considered in the self-pay optimization discussion.

While the four options invite a number of comparison models, especially with the existence of the hybrid model, for the simplicity of this discussion, we will compare just two models: the cost effectiveness of outsourcing to a third-party vendor vs. insourcing with existing staff using an in-house software platform.

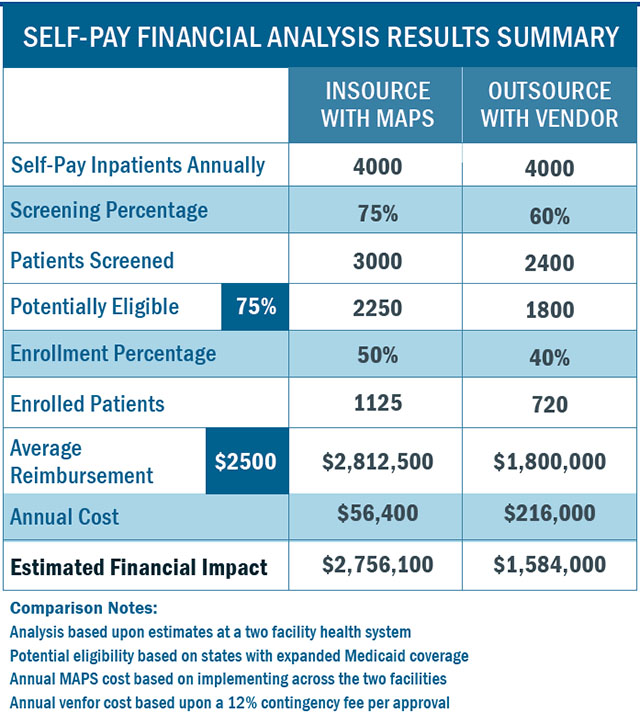

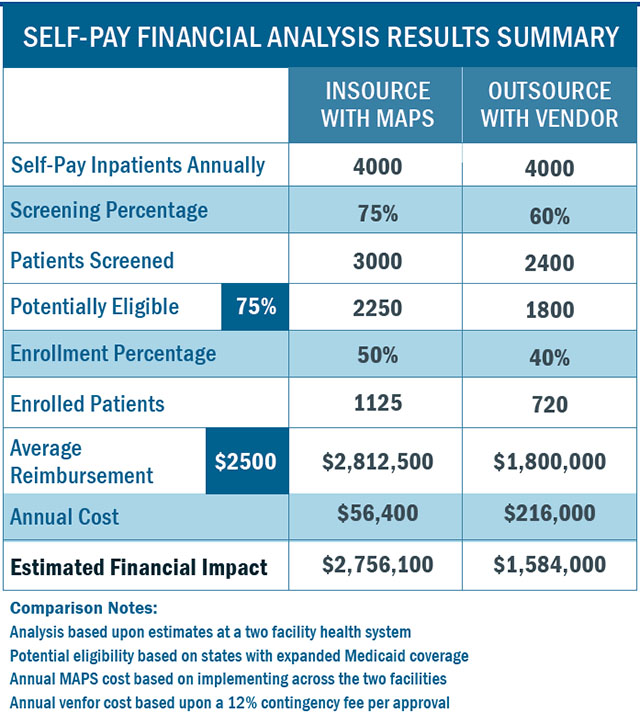

The following analysis shows the results of this comparison:

This return cost and comparison is based on an analysis of several key data points, filled in with averaged data and educated estimates. To better understand this chart, let’s break down the most variables listed in the left-hand column.

1. Screening percentage

Screening percentage is the number of self-pay patients you are able to screen for assistance program eligibility. Simply put, if you see 7,000 self pay patients per year and screen 3,500 of them, your screening percentage is 50%. This number does not factor in whether they qualify for assistance programs, but only if your staff was able to meet with and screen them for eligibility.

When working with a third-party vendor, screening percentage tends to be limited as it depends almost entirely on their ability to cover your organization and the amount of staff they have deployed on site.

With an in-house software solution, your staff can screen on site. The software can be distributed and deployed across multiple functions like patient financial services, patient access, registration, emergency department, etc. With the same software in use at multiple points of access, you’re likely to screen a higher percentage of individuals.

When fully deployed, the screening percentage for inpatient accounts should approach 75%. With an outsource vendor this percentage will be closer to 60% of the self-pay patient population.

2. Eligibility percentage

Eligibility percentage is the number of screened self-pay patients who are eligible for assistance, or are “accepted into inventory.” While a patient’s eligibility is completely out of your control, basic math says the more patients you screen, the more will be marked as eligible.

When a third-party vendor screens only 60% of self-pay patients vs. your in-house staff, which screens 70%, as in Point One, you will end up with more eligible patients overall. If a patient was not screened, there’s no way they can be marked as eligible. Starting from a higher number leads to a higher eligibility percentage. (Please note these numbers are based on a Medicaid expansion state.)

3. Enrollment percentage

Enrollment percentage is the conversion of eligible individuals to revenue generating reimbursement programs such as Medicaid. This number is boosted when in-house staff are deployed to enroll self-pay patients as they are able to leverage the relationship the patient already has with the hospital and its staff. Patients are more likely to cooperate and engage with the organization most directly coordinated with their care rather than a third-party vendor they have not heard of.

Hospitals using in-house staff also have an advantage as they can complete the enrollment process more in real time as the patient is receiving care. While patients are on the mend, staff is able to work with them on financial aspects to get their accounts covered. Third-party vendors have much more limited access to the patient during care and lack this advantage.

With an in-house software solution the financial counselors are walked through the enrollment process from collecting all required information and forms, to application submission. Diligently following these steps should result in enrollment percentages above 50% of those potentially eligible. Results from an outsource vendor will vary but are typically closer to a 40% conversion rate.

4. Annual Cost

The annual cost is defined as the cost to convert self-pay accounts to reimbursed accounts enrolled in programs like Medicaid. This number depends on the self-pay management model you have chosen to employ.

Software solutions usually come with fixed monthly licensing fees based on the number of facilities and users in the health system. Meanwhile, the outsource vendor will likely be paid a contingency fee based on the approved account reimbursement. This fee can be between 10% and 15%. Also, given that most health systems have staff in place to manage their financial assistance programs, more resources are typically not needed when utilizing a software solution.

5. Revenue

This is the final, big picture data point important to CFOs. Revenue is the total financial impact of your chosen model of self-pay management, encompassing all possible factors. It is a measure of how much money you will bring in using that model rather than how much it will cost.

In-house management vs. third-party

Let’s revisit our analysis comparing in-house self-pay management using software against outsourcing the process to a third-party vendor.

Even if you chose to ignore the first four points, revenue alone paints a strong picture of the financial impact of keeping self-pay management in house. The potential revenue associated with keeping the process within your current staff far outweighs that of outsourcing.

Zooming out and looking at all five key data points, in-sourcing self-pay management can lead to a higher screening percentage and enrollment percentage. It can lower costs associated with outsourcing and ultimately increase health system revenue.

Meet Bluemark’s MAPS solution

The Bluemark MAPS family of solutions helps providers to accurately and efficiently assess the uninsured or underinsured, properly qualify them for appropriate assistance programs, and provide complete enrollment support in a single technology platform. Featuring intuitive technology and a modular architecture, MAPS is the only eligibility and enrollment technology solution that can be fully configured to meet your needs.

MAPS enhances providers’ existing self-pay management processes – whether outsourced or in-sourced to efficiently screen and enroll patients for all types of programs, including Medicaid, Financial Assistance, health insurance exchanges and more.

Remember, investing in a smart software is the only way to maximize your in-house capabilities, leading to an increase in your bottom line. Stop overpaying third-party fees and take the job into your own hands with MAPS.