Healthcare revenue integrity is the holistic process of managing revenue cycle-related people, processes and platforms to eliminate issues that lead to noncompliance, revenue leakage and degradation.

This process used to be called “revenue optimization,” but the term “revenue integrity” has become more prominent as it includes fringe organizational functions like legal and contractual compliance.

Revenue integrity has become an integral part of the overall revenue management cycle in healthcare. Its origins began in the 1990s, when medical coding became more complex. In 2004, the Centers of Medicare and Medicaid Services mandated hierarchical condition categories (HCCs). In 2015, the same organization required the industry transition from ICD-9 to ICD-10.

The complications introduced by these factors, among others, meant revenue cycle integrity became necessary to prevent issues impacting healthcare financials. There is now even a professional organization dedicated to revenue integrity maintenance, the National Association of Healthcare Revenue Integrity (NAHRI).

Many types of organizations have plans and processes in place to prevent errors in revenue cycle management. But within healthcare, revenue integrity usually encompasses optimizing three key aspects:

- People:Several different human resources and/or departments are involved in any one organization’s revenue cycle, oftentimes each operating within their own specialty and silo. With enhanced revenue integrity, these employees can better work together as a team, aligning their respective functions to achieve organizational goals.

- Process:Part of helping employees work together cross departmentally is the implementation of specialized processes and best practice workflows that increase compliance and reimbursement.

- Platforms:When processes became more complicated, the industry responded appropriately, developing technology-based solutions to enhance revenue integrity. These platforms perform a variety of functions, often using artificial intelligence and machine learning to collect and connect previously siloed data.

Why revenue integrity matters in healthcare

Simply put, organizations without a revenue integrity program are likely facing an underperforming revenue cycle. There are several reasons why revenue cycle teams should have an integrity program in place.

- Saves time: Several different human resources and/or departments are involved in any one organization’s revenue cycle, oftentimes each operating within their own specialty and silo. With enhanced revenue integrity, these employees can better work together as a team, aligning their respective functions to achieve organizational goals.

- Saves money: Part of helping employees work together cross departmentally is the implementation of specialized processes and best practice workflows that increase compliance and reimbursement.

- Reduce risk of audits: When processes became more complicated, the industry responded appropriately, developing technology-based solutions to enhance revenue integrity. These platforms perform a variety of functions, often using artificial intelligence and machine learning to collect and connect previously siloed data.

- Reduce payment denials: In the same vein, coding correctly and consistently can also reduce payment denials, creating a positive financial impact on the organization.

- Legal compliance: In the same vein, coding correctly and consistently can also reduce payment denials, creating a positive financial impact on the organization.

- Creates a central knowledge base: Because revenue integrity programs are implemented organization-wide, the process automatically creates a knowledge base all departments and new employees can access for information and answer questions. This knowledge base serves as a bridge between previously siloed employees.

Maintaining healthcare revenue integrity

Many, if not all, CFOs recognize the importance of revenue integrity, but it can be difficult to work out the right process for implementing revenue integrity across an organization, especially in larger hospitals and health systems.

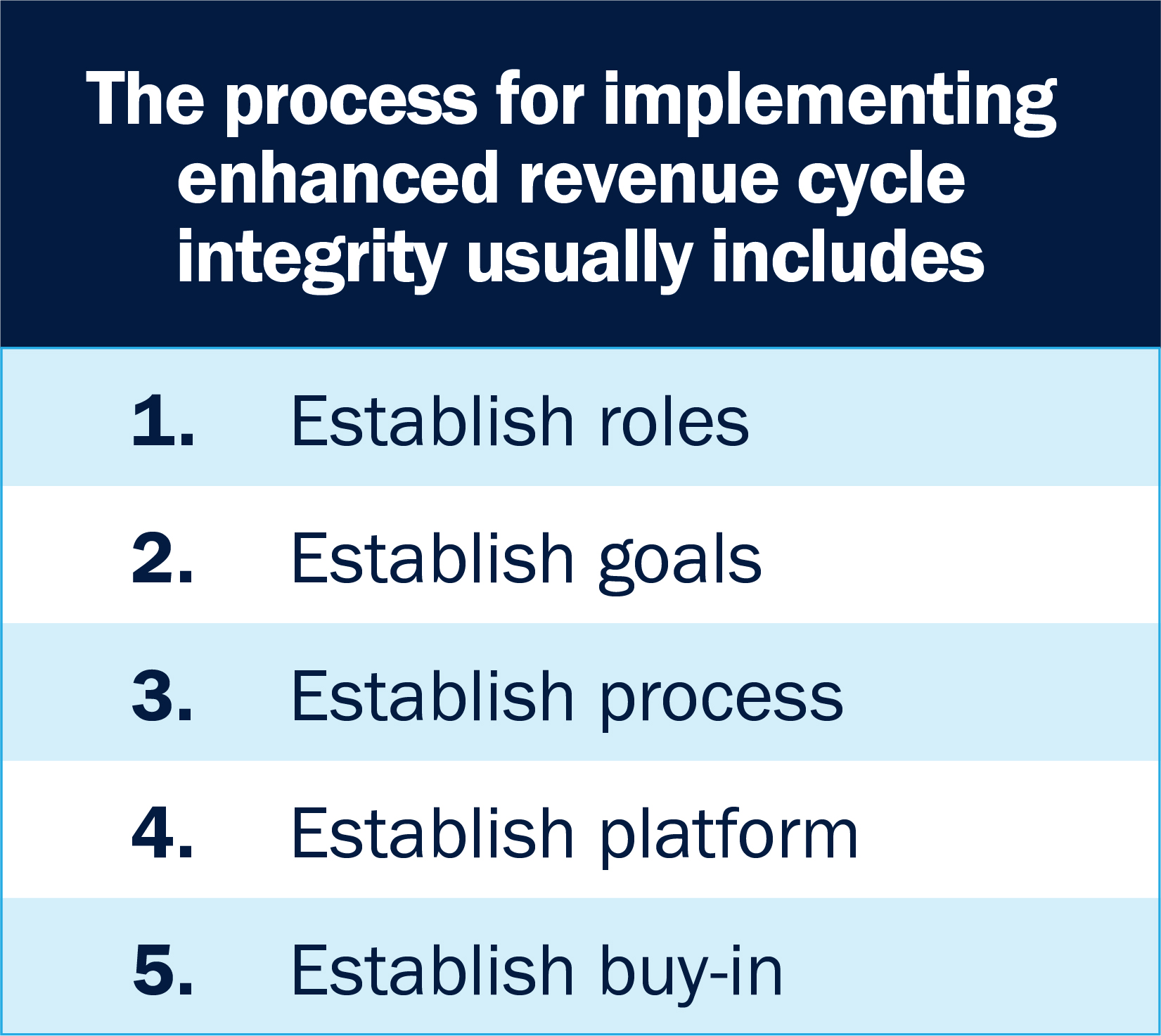

The good news is revenue integrity is usually an extension of established processes. Management isn’t required to start from scratch or remove existing processes, and can add on revenue integrity best practices at their organization’s pace and as they see fit. The process for implementing enhanced revenue cycle integrity usually involves the following steps:

1. Why revenue integrity matters in healthcare

Revenue integrity involves a change in process from the top down, requiring proper leadership to implement and maintain new programs. Some organizations create new revenue integrity management roles from scratch, which exist solely for the continued improvement of revenue cycle processes.

Even organizations without a revenue integrity director can appoint a cross-functional leadership team to take charge. Representatives from clinical, compliance and revenue teams should take part in this committee, which should be led by one person tasked with project management.

Some organizations also elect to skip internal appointments and instead work with an objective third party partner already fluent in integrity best practices. Whether you choose a new hire, existing committee or third party depends on the size of your organization’s revenue issues and skill sets.

2. Establish goals

The person or persons in charge of revenue cycle integrity should start by establishing goals based on the current state of the organization’s revenue cycle. Goals can be centered around accounts receivable timelines, documentation, process optimization, audit response, workflows, billing systems, charge process efficiency, etc.

The end product varies from organization to organization, but goals should ultimately center around improving clinical, compliance and revenue workflows to reduce errors and the need for edits.

3. Establish process

Revenue integrity improvements simply will not stick without a clear, documented and detailed strategy. All employees and leadership involved in revenue cycle management should be able to (and expected to) follow new procedures.

Start by analyzing your current workflows and brainstorming improvements. Review processes related to your goals and how they can be improved. All finalized policies and procedures should be reviewed by 2-5 others. Note this is by far the longest step in the process requiring the most scrutinization.

4. Establish platform

Once you know what you want to change about your workflows, make sure your current technologies are up to date and able to handle new processes. Oftentimes, this will involve selecting a new technology solution.

5. Establish buy-in

Creating a revenue integrity program that sticks means getting buy-in from several stakeholders across your organization. As we established, departments are traditionally siloed and divided between clinical, compliance and revenue cycle-related departments. Separating employees this way makes it difficult to work together to implement new processes.

Transparency and appropriate communication are key to ensuring everyone is working toward the same goals and understands their role and expectations. Remember, you may have been working on new processes for months, but these ideas are new to employees. Resistance to change is natural, and it may take some time before every stakeholder is on board.

It’s at this point that hospitals and health systems that invested in a third party partner early on may be grateful for the foresight. For larger entities, a knowledgeable, experienced partner can be invaluable in identifying and overcoming obstacles during rollout.

Healthcare revenue integrity solutions

Revenue integrity is a process. It does not take place overnight, nor can it be achieved without the right mix of people, process and platforms unique to your organization.

Bluemark’s software solutions, especially our MAPS self-pay management platform, have played an integral role in many organizational journeys to revenue integrity. We will also soon be offering several new products specifically focused on revenue integrity.

- MAPS: Our self-pay patient management software helps hospitals convert their self-pay patient population into revenue generating assistance programs. It provides operational efficiency in self-pay account management and Medicaid enrollment by optimizing reimbursement opportunities after service.

- Insurance Coverage Discovery: One of our newest offerings, this program increases revenue by identifying billable insurance on self-pay patients on their date of service.

- Medicare Underpayments/Medicare Transfer DRG: Medicare care slowed during the pandemic which caused decline in discharges to follow up care. The need to maximize revenue in all areas is paramount as Medicare picks back up. This new offering optimizes reimbursement opportunities specifically for Medicare accounts.

Healthcare revenue integrity is a continually evolving industry requiring prompt response to change. We look forward to further developing our software solutions around revenue integrity, making process change and rollout simple and long-lasting.

Click here for more information on our MAPS self-pay patient reimbursement program.